• Improve efficiency in a specific process?

• Increase accuracy in Predict?

• Minimize costs or maximize profits?

• Enhance decision-making for a particular metric?

Understanding your target outcome helps us tailor the model to your needs, whether it’s for binary classification (like predicting a good or bad outcome) or regression tasks (like forecasting a continuous value). Once we define the outcome, we’ll proceed with data preparation and model training to deliver the insights you’re looking for.

• I am working with a financial dataset that focuses on predicting customer delinquency. The target variable, 'Delinquency Company First DPD 31+ Days,' is defined as 0 for customers who do not default ('Not Default') and 1 for those who default ('Default'). My primary objective is to develop strategies and predictive insights to reduce the delinquency rate by 20%, improving overall financial stability and customer repayment behavior.

• Target Outcome Improvement: This is the desired percentage improvement in the target variable, within -20% to +20% (e.g., -10 for reducing defaults by 10%).

• Target Variable Type: Specify whether the target variable is 'Categorical' or 'Numerical'.

• Good Outcome: The label representing a positive or desirable outcome in your target variable (e.g., 'Not Default').

• Bad Outcome: The label representing a negative or undesirable outcome in your target variable (e.g., 'Default').

• Good Outcome Value: The numerical value for the good class (e.g., 0 if 'Not Default' is considered positive).

• Bad Outcome Value: The numerical value for the bad class (e.g., 1 if 'Default' is considered negative).

You have uploaded the file successfully: Loan_default.csv

Message received: I am working with a financial dataset that focuses on predicting customer delinquency. The target variable, 'Delinquency Company First DPD 31+ Days,' is defined as 0 for customers who do not default ('Not Default') and 1 for those who default ('Default'). My primary objective is to develop strategies and predictive insights to reduce the delinquency rate by 20%, improving overall financial stability and customer repayment behavior.

• Target Outcome: Delinquency Company First DPD 31+ Days

• Good Outcome: Not Default

• Bad Outcome: Default

• Good Outcome Value: 0

• Bad Outcome Value: 1

• Target Outcome Type: Categorical

• Target Outcome Improvement: - 20%

• Target Outcome Improvement Status: in range

• All variables are complete. Model execution will now begin.

Exploratory Data Analysis: SXI Score Distribution and Delinquency Outcomes

In this analysis, we delve into the relationship between the SXI Score and the target feature Delinquency Company First DPD 31+ Days, with outcomes categorized as Not Default and Default.

Benchmark SXI Score and Current Outcome Percentage

The current benchmark SXI Score stands at 0.705, with a corresponding outcome percentage of 15.08% classified as Default.

Relationship between SXI Score and Delinquency Outcomes

Not Default Above SXI Score of 0.705:

• Percentage: 16.18%

• Contribution to Total Not Default: 48.32% of Total 84.92%

Default Below SXI Score of 0.705:

• Percentage: 80.78%

• Contribution to Total Default: 7.07% of Total 15.08%

Observations and Hypothesis:

• The SXI Score of 0.705 acts as a crucial threshold for classifying outcomes.

• Not Default cases are more likely to have an SXI Score above 0.705, contributing significantly to the majority of Not Default cases.

• Default cases are more prevalent below the SXI Score threshold, indicating a strong association between lower scores and higher default rates.

Predictive Power of SXI Score :

• The SXI Score demonstrates a predictive power in differentiating between Not Default and Default outcomes.

• With Not Default cases being more prevalent above the SXI Score benchmark, there is potential to leverage the SXI Score for targeted improvements.

• By aiming to reduce the Default outcome percentage to the target of 12.64%, focusing on improving the SXI Score above 0.705 could be a viable strategy.

In conclusion, the SXI Score serves as a valuable tool in understanding and predicting delinquency outcomes. Leveraging this score effectively could lead to achieving the desired target improvement in reducing default rates. Further analysis and strategic interventions based on the SXI Score can enhance risk management and decision-making processes within the context of delinquency management.

Delinquency Company Analysis Report

Summary of Analysis:

- Current Default Rate: 15.08% (591 Defaults), indicating a decrease for the target outcome 'Default' with an immediate target outcome of 12.64%.

- SXI Score Correlation: Currently SXI score at 0.705, with an R-squared value of 0.97, demonstrating a negative correlation. This emphasizes the role of the SXI score in influencing the default rate.

Analysis Structure:

- Immediate Term: Achieving a 20% decrease in default reduces the count by 118, aligning with a target SXI score of 0.765. This phase focuses on swift, practical measures for immediate benefits.

- Mid-Term Improvements: A 53.31% decrease in default equates to a reduction of 315, with a targeted SXI score of 0.9. This phase involves moderate adjustments for sustained progress.

- Long-Term Success: A 90.5% decrease in default results in a reduction of 535, targeting a significantly improved SXI score of 1.43. This phase demands comprehensive, transformational changes to achieve lasting improvements.

The data highlights that increasing the SXI score directly correlates with reducing default rates, providing a clear, actionable roadmap for success.

Interpretation and Significance:

These metrics play a crucial role in evaluating the model's performance by showcasing the correlation between the Delinquency Company First DPD 31+ Days rate and the SXI score. The decreasing default rates with corresponding target SXI scores indicate a direct relationship between borrower behavior (as reflected in the SXI score) and loan delinquency.

For actionable strategies, the identified immediate, mid-term, and long-term goals provide a structured approach for improving default rates by focusing on enhancing the SXI score. Immediate measures target quick wins, mid-term improvements aim for sustained progress, while long-term success demands transformative changes to achieve lasting improvements in loan performance and borrower behavior.

Performance Evaluation Report: SXI Model

Summary of Evaluation Metrics:

Model Accuracy: 98.60%

Precision Score: 92.50%

Area Under the Curve (AUC): 0.997

Accuracy Matrix :

True Negatives (Actual Not Default, Predicted Not Default): 662

False Positives (Actual Not Default, Predicted Default): 9

False Negatives (Actual Default, Predicted Not Default): 2

True Positives (Actual Default, Predicted Default): 111

Additional Analysis:

Percentage of Correctly Predicted Not Default: 98.66%

Percentage of Incorrectly Predicted Not Default: 1.34%

Percentage of Correctly Predicted Default: 98.23%

Percentage of Incorrectly Predicted Default: 1.77%

Interpretation :

Model Accuracy (98.60%):

This metric indicates the overall correctness of the model's Predict. An accuracy of 98.60% suggests that the model is highly effective at classifying loan default and non-default cases.

Precision Score (92.50%):

Precision measures the proportion of correctly predicted default cases out of all predicted default cases. A precision score of 92.50% shows that when the model predicts a loan default, it is correct 92.50% of the time.

Area Under the Curve (AUC) (0.997):

An AUC score of 0.997 signifies that the model has excellent discrimination ability in separating default and non-default cases.

Accuracy Matrix :

The Accuracy Matrix provides a detailed breakdown of the model's Predict. In this case, we see a high number of true negatives (662) and true positives (111), indicating that the model performs well in both classes.

Additional Analysis:

The percentages of correctly and incorrectly predicted default and non-default cases provide further insights into the model's performance. High percentages of correctly predicted cases (>98%) demonstrate the model's reliability in making accurate Predict.

Overall, the SXI model demonstrates exceptional performance in classifying loan default cases, as evidenced by high accuracy, precision, AUC score, and percentages of correctly predicted cases. The model's ability to accurately identify default and non-default cases showcases its effectiveness in risk assessment and decision-making processes.

Current Decision Tree

Path Identified for Not Default

- • Average Company ARR: <= $51,281,518

- • Average Company ARPU: >= 8.195

- • Average Quick Ratio: >= 0.145

- • Average Gross Churn %: <= 0.145

Path Identified for Default

- • Average Company ARR: >= $51,281,518

- • Average Logo Growth MoM: >= 0.027

- • Average LTV CAC Ratio: >= 3.35

- • Sector: Consumer Goods & Services

- • Average Current Ratio: >= -0.66

- • Average Debt to Equity Ratio: >= 0.42

Explanation of how the SXI algorithm identified the important features:

The SXI algorithm uses feature importance scores to rank the contribution of each feature to the model's predictive accuracy. The most important features, such as "Average Quick Ratio" (18.92) and "Average ARPU" (18.52), have the highest scores, indicating their significant role in distinguishing between "Not Default" and "Default" outcomes. Other features like "Average Logo Growth MoM" and "Average Current Ratio" also contribute to the prediction based on their respective importance scores. These scores are derived from the algorithm's analysis of the variance explained by each feature during model training.

Explanation of the accuracy of the threshold values:

The thresholds identified in the decision tree are highly accurate, as indicated by their associated probabilities. For example, the "Default" path for "Average Company ARR >= $51,281,518" has a 100% probability, reflecting strong predictive confidence. Similarly, the "Not Default" path with "Average Quick Ratio >= 0.145" has a 90.69% probability, suggesting a reliable classification. The probabilities highlight the thresholds' ability to segment the data effectively and predict outcomes accurately.

Reliability of the thresholds:

The thresholds identified are reliable, given their strong probabilistic associations. Features like "Average Company ARR" and "Average Quick Ratio" consistently differentiate between "Default" and "Not Default" across various ranges. However, the slightly lower probability (86.66%) for "Average Debt to Equity Ratio >= 0.42" suggests it may be less robust than other thresholds. These thresholds can be considered reliable for decision-making, especially when combined with the SXI algorithm's insights to ensure comprehensive Predict.

Target Decision Tree

Path Identified for Not Default

- • Annual Growth %: >= -0.099%

- • Average MRR: <= $1,856,340.062

- • Avg Logo Growth MoM: >= -0.041

- • Average Quick Ratio: >= 0.196

- • Gross Dollar Churn: >= 0.0

Path Identified for Default

- • Gross Dollar Churn: >= 0.181

- • Average Gross Margin: >= 0.316%

- • Average Monthly Operating Burn: >= -0.141

- • Average Company ARR: >= $3,487,150.75

Explanation of how the SXI algorithm identified the important features:

The SXI algorithm prioritizes features with the highest scores in the feature importance ranking. "Average MRR" (15.95) and "Annual Growth %" (13.02) are the most influential features, contributing significantly to the prediction of "Default" and "Not Default" outcomes. Additionally, "Average Monthly Operating Burn" and "Average Gross Margin %" are also highlighted as key predictors due to their high feature importance scores. These scores are computed based on the variability each feature explains in the target variable during training.

Explanation of the accuracy of the threshold values:

The thresholds identified in the decision tree are supported by high probabilities, indicating strong classification capabilities. For example, the "Default" path with "Gross Dollar Churn >= 0.181" and "Average Gross Margin >= 0.316%" has a 100% probability, reflecting perfect predictive reliability. Similarly, the "Not Default" path with "Average MRR <= $1,856,340.062" and "Annual Growth % >= -0.099%" achieves an 89.98% probability, which suggests high classification accuracy.

Reliability of the thresholds:

The thresholds are highly reliable, as their associated probabilities validate their effectiveness in distinguishing between "Default" and "Not Default." However, thresholds like "Average Company ARR >= $3,487,150.75" with a 75% probability may have slightly lower confidence and could benefit from further evaluation or refinement. The overall reliability is enhanced by combining these thresholds with SXI algorithm insights to create a robust predictive framework.

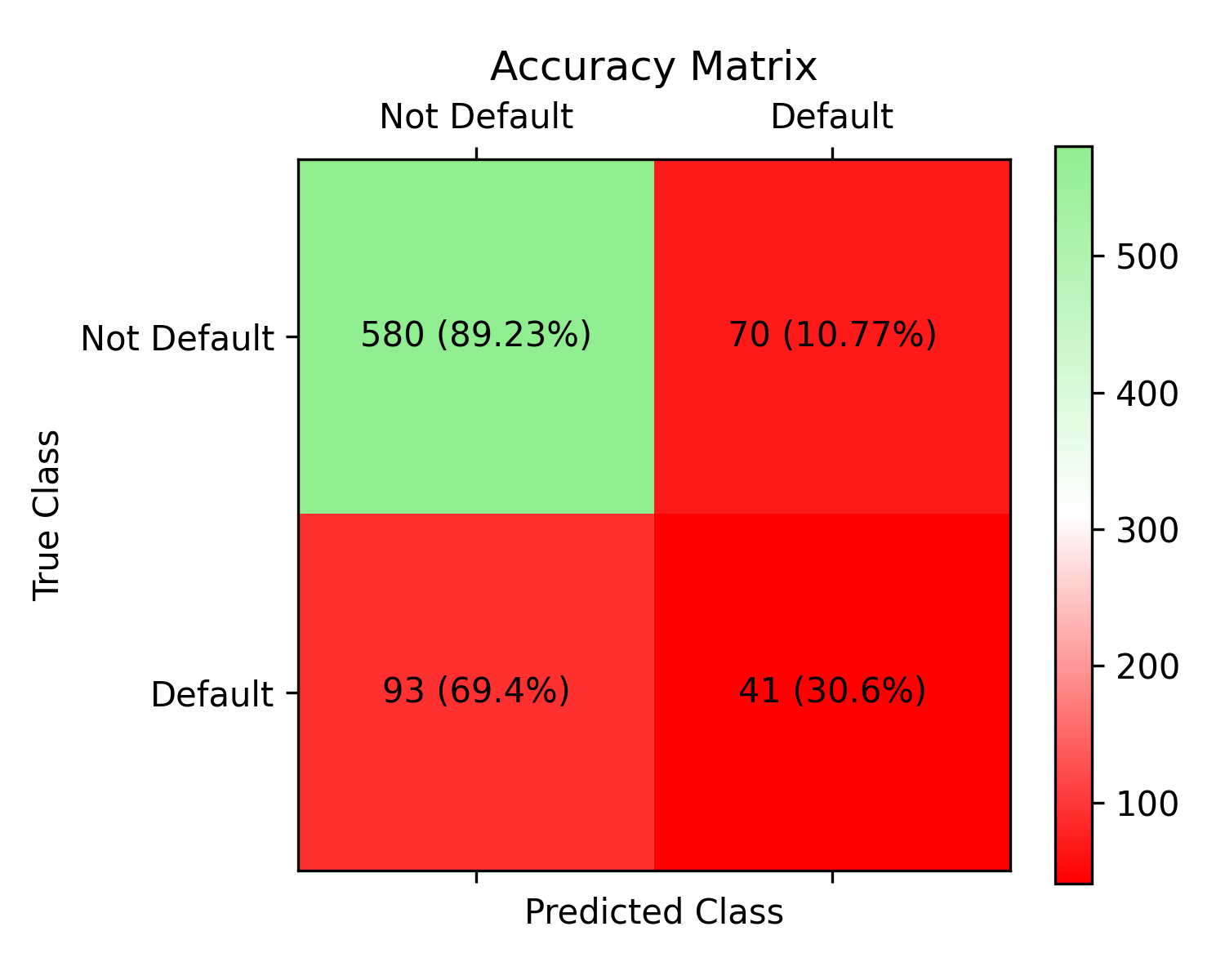

Auto-ML Model Performance Report

Summary:

Algorithm Used:Decision Tree

Model Accuracy: 79%

Precision Score: 37%

Area Under the Curve (AUC): 0.60

Accuracy Matrix :

True Negatives (TN): 580

False Positives (FP): 70

False Negatives (FN): 93

True Positives (TP): 41

Additional Analysis:

Percentage of Correctly Predicted Not Default: 89.23%

Percentage of Incorrectly Predicted Not Default 10.77%

Percentage of Correctly Predicted Default: 30.6%

Percentage of Incorrectly Predicted Default: 69.4%

Interpretation:

The model accuracy of 79% indicates that the model's overall correctness in predicting both default and non-default cases is low. It suggests that the model may not be performing well in distinguishing between the two classes.

Precision Score:

The precision score of 37% implies that when the model predicts a default case, it is correct only 37% of the time. This metric is crucial for evaluating the reliability of positive Predict made by the model.

Area Under the Curve (AUC):

The AUC score of 0.60 indicates the model's ability to distinguish between positive and negative classes. A value closer to 1 signifies a better-performing model, while 0.5 suggests random guessing. In this case, the AUC score is moderate, indicating some discrimination capability.

Accuracy Matrix :

The Accuracy Matrix provides a detailed breakdown of the model's performance in predicting true positives, true negatives, false positives, and false negatives. It reveals that the model has a relatively high number of false positives and false negatives, indicating areas where the model can be improved.

Additional Analysis:

• The high percentage of correctly predicted not default cases (89.23%) suggests that the model is better at predicting non-default instances.

• Conversely, the low percentage of correctly predicted default cases (30.6%) indicates a weakness in predicting defaults accurately.

• The high percentage of incorrectly predicted default cases (69.4%) highlights a significant area for model improvement to reduce false Predict.

Conclusion:

Overall, the Decision Tree model created and optimized by ChatGPT shows some performance issues, especially in accurately predicting default cases. Further optimization and possibly exploring other algorithms may be necessary to enhance the model's predictive capabilities and improve its overall performance.